Seed funding on the rise in 2023

Series C and D startups experiencing hardships

This article is attributed to Anita Ramaswamy who wrote in detail about this on Reuters.

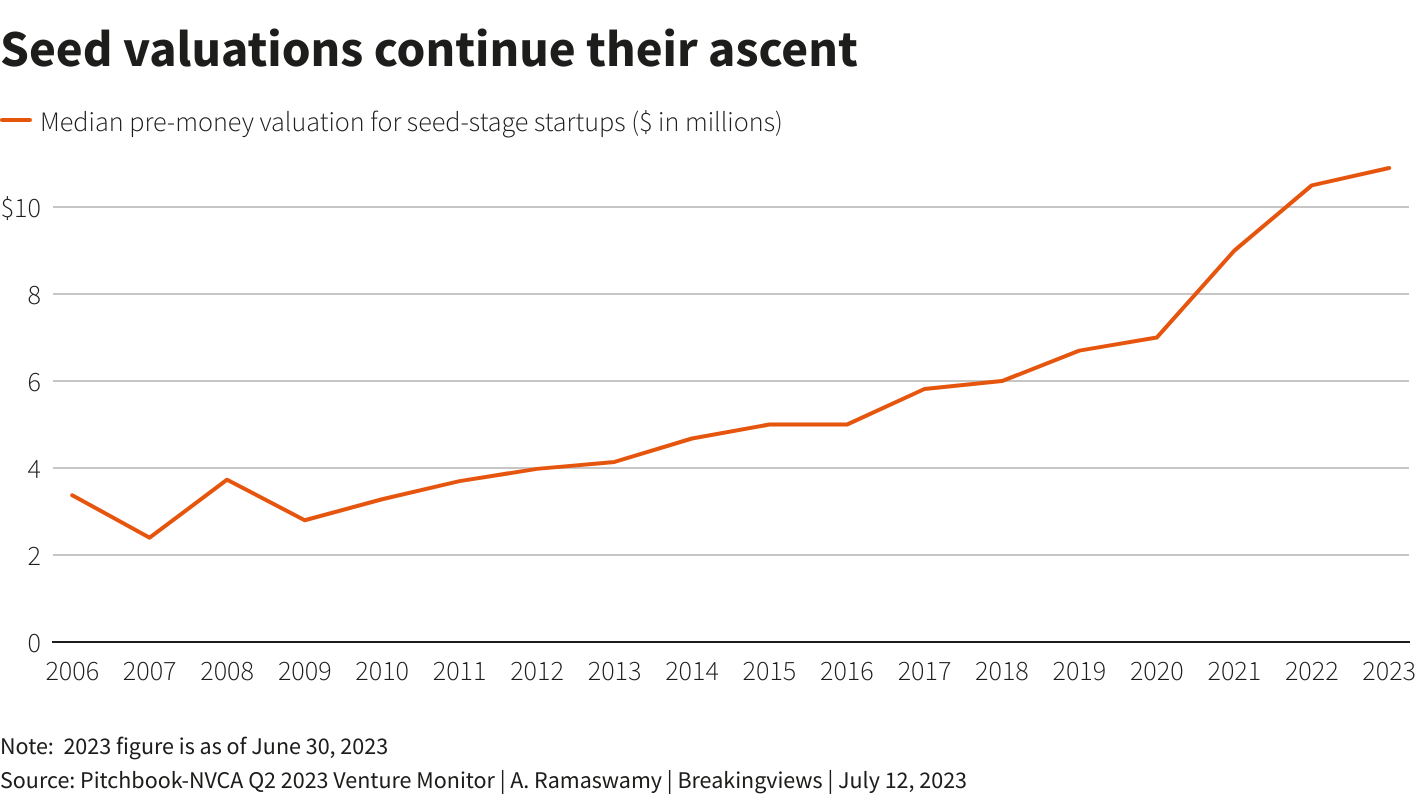

Despite a slowdown in venture capital investments, the technology investment bubble has not burst; it has merely shifted. According to a recent report by PitchBook and the National Venture Capital Association, early-stage companies appear to be immune to the downturn that has affected other stages of startups. In fact, the median pre-money valuation for seed-stage startups reached $10.9 million in 2023, marking the highest level in a decade and a four-fold increase since 2006. While valuing startups can be unpredictable, this upward trend suggests sustained confidence in the potential of these early-stage ventures.

In contrast, late-stage startups are experiencing a squeeze in funding. The report reveals that the demand for new capital among these companies was nearly three times higher than the available supply in the previous quarter. Data from the equity management platform Carta further supports this, showing that valuations for Series C and D startups dropped by 23% and 59%, respectively, compared to the beginning of 2021. This decrease in valuations indicates the challenges faced by more mature startups in securing the necessary funds to sustain their growth.

Additionally, the report highlights a decline in the number of seed-stage startups receiving venture funding during the second half of this year. Compared to the same quarter in the previous year, there was a significant 25% drop in funding for these early-stage ventures. Despite the overall decrease in investments, the resilience and attractiveness of early-stage companies continue to shape the venture capital landscape, maintaining optimism for their future success.

In summary, while venture capital investments have experienced a decline in recent quarters, early-stage startups remain a bright spot in the market. These nascent companies have seen their valuations rise to the highest level in a decade, indicating sustained investor confidence. Conversely, late-stage startups face challenges in securing funding, with valuations dropping significantly. The number of seed-stage startups receiving venture funding has also decreased, highlighting the current state of the venture capital landscape.